CeraVe just made NBA history - becoming the league’s first-ever official skincare and haircare partner. The deal takes the brand far beyond pharmacy aisles, placing it courtside at marquee events like NBA All-Star, the Emirates NBA Cup, and NBA Summer League.

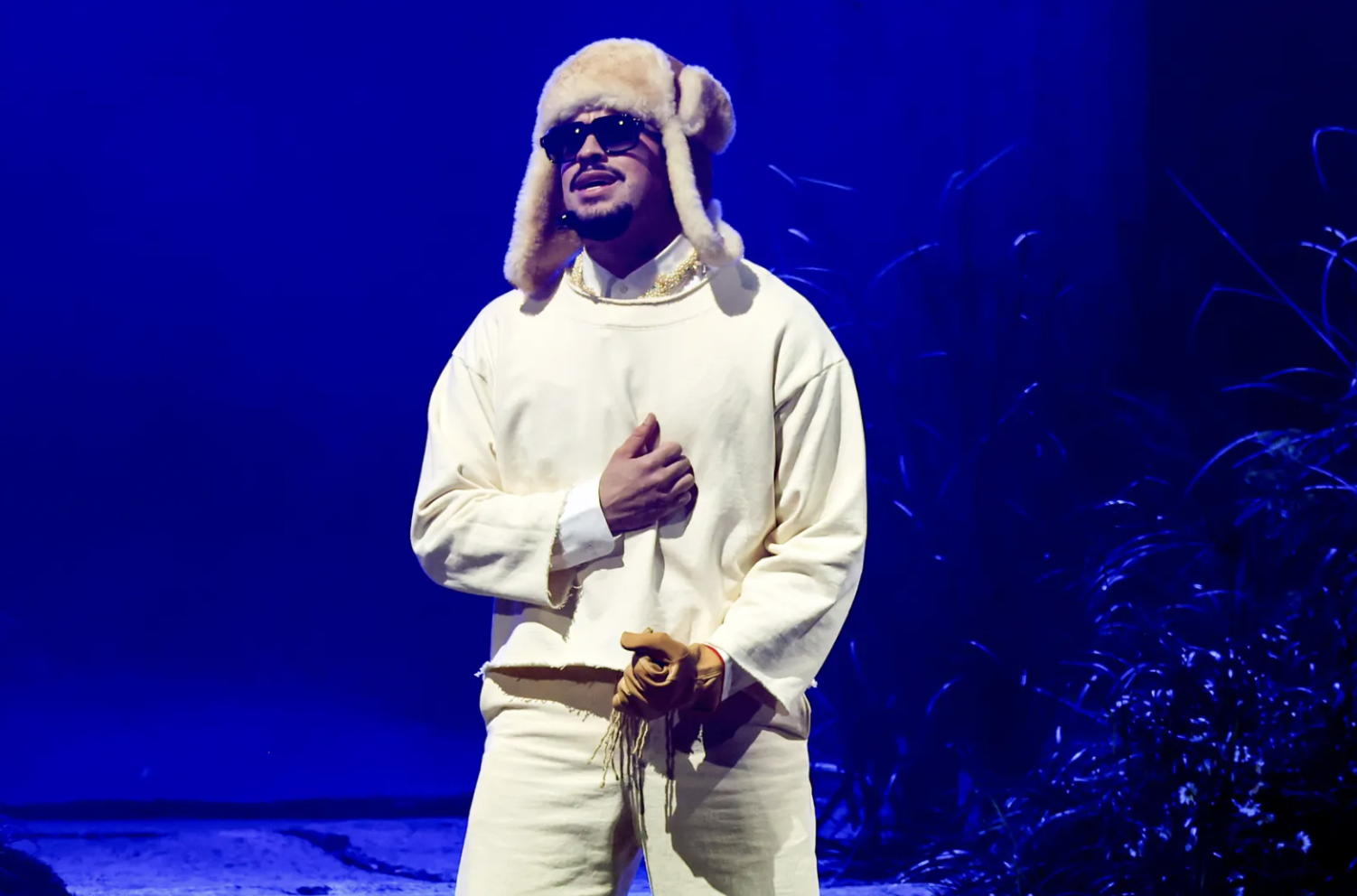

It’s not just logo placement. The partnership builds on CeraVe’s ongoing collaboration with 10-time All-Star Anthony Davis (“Head of CeraVe”) and extends into NBA 2K26, retail integrations, and a new youth-focused initiative, Care For All, that brings skincare education to Jr. NBA clinics across the U.S.

In short: this isn’t a sponsorship — it’s a full-court brand play.

📊 Supporting Stats

The U.S. skincare market is projected to hit $33.2 billion by 2028 (Statista, 2025).

47% of Gen Z men now use facial skincare products regularly (NPD Group, 2024).

The NBA’s digital platforms reach over 2.1 billion fans globally - a scale unmatched by most sports leagues (NBA, 2025).

That overlap - wellness-aware youth and digitally native basketball culture - is exactly where CeraVe wants to play.

🧠 Does It Work?

Yes - strategically, this is a slam dunk.

CeraVe’s move positions skincare as part of performance culture, not vanity. Partnering with the NBA reframes moisturiser as self-care for athletes and fans alike - merging health, sport, and style in a way that feels both modern and inclusive.

The integration into NBA 2K26 is particularly sharp - tapping the gaming audience where brand loyalty is built early and visually. And “Care For All” anchors the campaign in real-world purpose, extending credibility beyond marketing spin.

The risk? Relevance creep. Skincare and basketball don’t share natural equity. If the activations lean too corporate or over-polished, the connection could feel contrived. Authenticity will depend on player involvement and community engagement - not just banner ads and product displays.

📌 Key Takeouts

What happened: CeraVe becomes the NBA’s first official skincare and haircare partner, launching cross-channel activations and educational youth programmes.

What worked: Smart alignment with wellness and performance; integration across content, gaming, and real-world touchpoints.

What’s risky: Maintaining authenticity in a space traditionally dominated by sneaker, drink, and apparel brands.

Why it matters: Reflects the broader cultural convergence of self-care and sport - especially among Gen Z male consumers.

Brand takeaway: Health is now part of the lifestyle economy - and performance brands are broadening to include skincare, sleep, and mental wellness.

🔮 What We Can Expect Next

Expect more beauty and personal care brands to move into performance culture - where wellness, sport, and identity merge. If CeraVe can translate credibility on the court to credibility in culture, it could open a new category of partnerships built on care as performance.

Nike might own sweat. CeraVe wants to own recovery.