On The Recrod Linkedin Newsletter: 15th September 2025

⚪️👛 Louis Vuitton Dresses Real Madrid Women: Luxury Meets the Pitch

Louis Vuitton has extended its partnership with Real Madrid into the women’s game, unveiling an exclusive official wardrobe for the squad. This is more than fashion - it’s a calculated brand play that fuses luxury with elite women’s sport at a moment when visibility and commercial investment in the women’s game are accelerating. The wardrobe spans tailoring, footwear, accessories, and luggage, all in Real Madrid’s white-and-gold palette. It’s the first time the French maison has designed for the women’s side, following its men’s collaboration earlier this year.

📊 Supporting Stats:

Women’s football is a booming commercial space: UEFA reported a 300% increase in sponsorship revenue in the Women’s Champions League since 2020 (UEFA, 2024).

Real Madrid Women have one of the fastest-growing fanbases in Europe, with social media followings up 25% YoY in 2024 (Blinkfire Analytics).

The global luxury sportswear market is projected to reach $231 billion by 2030, growing at 8.4% annually (Grand View Research, 2025).

🧠 Decision: Does It Work?

Yes - for both sides. For Louis Vuitton, this move reinforces its alignment with cultural dominance through sport, signalling that women’s football deserves the same treatment and prestige as the men’s game. For Real Madrid, it positions the women’s squad as luxury ambassadors, elevating their image beyond the pitch and into lifestyle relevance. The commercial value may be subtle - LV won’t be selling these wardrobes - but the brand equity gained is high.

📌 Key Takeouts:

What happened: Louis Vuitton unveiled an exclusive official wardrobe for Real Madrid’s women’s team.

What worked well: Extends LV’s sports portfolio; puts women’s football on equal footing with men’s in luxury treatment; aligns with rising audience demand.

What didn’t land: Limited commercial activation - no public access to the pieces could restrict broader brand buzz.

What it signals: Women’s football is now a platform for prestige partnerships, not just grassroots support. The sport is repositioned as a lifestyle and luxury canvas.

Brand lesson: Prestige brands can elevate women’s sport while protecting exclusivity - visibility and symbolism matter as much as direct product drops.

🔮 What We Can Expect Next:

Expect more luxury houses to selectively back women’s sport - not just via sponsorship logos but through lifestyle integrations, wardrobes, and bespoke pieces. As luxury looks to expand cultural relevance without oversaturating hype collabs, women’s football offers a fertile, less-exploited territory. The risk? If these projects remain “non-commercialised,” fans may see them as token gestures. The opportunity is to build a deeper luxury-sport ecosystem where women’s teams are equal players, not symbolic extensions.

🔥 Roblox Under Fire: When a Child’s Safe Space Becomes Unsafe

The story of 15-year-old Ethan Dallas - groomed through Roblox from the age of 7, coerced via Discord, and tragically lost to suicide - exposes the cracks in how platforms marketed as “safe” for kids actually operate. His mother’s wrongful death lawsuit against Roblox and Discord is one of the first of its kind. It frames a bigger cultural reckoning: can platforms that profit from children’s time and creativity be held responsible for predators who exploit their systems?

📊 Supporting Stats

Roblox user base: 70+ million daily active users, with over a third under age 13 (Roblox Q2 2025 earnings).

Scale of lawsuits: More than 20 lawsuits accusing Roblox of enabling sexual exploitation have been filed in U.S. federal courts this year (NYT review, 2025).

Child exploitation crisis online: Reports of online child sexual abuse material (CSAM) increased 87% between 2019 and 2023 in the U.S., according to the National Center for Missing and Exploited Children.

Industry pressure: Florida and Louisiana attorneys general have already opened child-safety investigations or lawsuits against Roblox in 2025.

From a safety and trust perspective, Roblox’s current system has failed. For years, Roblox positioned itself as the leading child-friendly metaverse, but its moderation and parental controls are now under intense scrutiny. What worked commercially - frictionless communication, user-generated creativity, and scale - became liabilities when exploited by predators.

This is a systemic brand risk. Roblox now sits in the same cultural conversation as Meta and Snap when it comes to youth harm. The difference? Roblox’s audience skews younger, meaning scrutiny is sharper and the margin for error thinner.

📌 Key Takeouts

What happened: A 15-year-old boy groomed on Roblox and Discord, leading to his suicide. His mother is suing Roblox in a landmark wrongful death case.

What worked: Roblox’s vast reach and engagement with children made it a pre-eminent digital playground.

What didn’t land: Weak parental controls, porous age verification, and inadequate moderation created a high-risk environment for grooming.

Signal for the future: Regulators and courts are now pushing to test the limits of Section 230, potentially reshaping liability for platforms.

For brand marketers: Trust is the new growth metric. Platforms that can prove safety and responsibility will win parental approval - and avoid devastating reputational fallout.

🔮 What We Can Expect Next

Legal precedent: If Ms. Dallas’s lawsuit succeeds, it could set a game-changing precedent, exposing not just Roblox but all youth-facing platforms to wrongful-death liability.

Regulatory clampdown: Expect state attorneys general to use Roblox as the test case for holding tech accountable, accelerating U.S. moves toward child online safety legislation.

Brand repositioning: Roblox may be forced into a pivot - from “limitless creative playground” to “safest online space for kids.” But that transformation requires deep investment in safety tech, transparency, and moderation.

Industry ripple effect: Other platforms popular with young users (Minecraft, Fortnite, Snapchat) will watch closely. If Roblox is made an example of, others will pre-emptively tighten their safety frameworks to avoid similar litigation.

👉 For brands and strategists, this case is a reminder: any partnership with youth-facing platforms now carries not just reputational upside but major risk. Trust and safety are no longer compliance line items - they’re core brand equity drivers.

⚽️ Chelsea FC Women Turn Stamford Bridge Into a Safe Space for Survivors

Chelsea Women have partnered with Hammersmith & Fulham Council to give free matchday tickets to women and children accessing domestic abuse services. The initiative kicked off at their season opener against Manchester City, welcoming 16 survivors and their families into the stands at Stamford Bridge.

This is a signal of how elite clubs can use their cultural capital to shift perceptions of football, create inclusive experiences, and link sport to social healing.

📊 Supporting Stats

1 in 4 women in the UK will experience domestic abuse in their lifetime (Office for National Statistics, 2023).

Research shows that participation in sport or fan communities can improve self-esteem and mental health, particularly for survivors of trauma (Women’s Sport Trust, 2024).

Chelsea Women’s home matches regularly attract 10,000+ fans - a scale that allows visibility for initiatives like this without losing intimacy.

🧠 Decision: Does It Work?

Yes. From a brand strategy perspective, this works because it aligns Chelsea Women with values of empowerment, inclusion and resilience - qualities central to the women’s game. Unlike generic CSR, the partnership is rooted in lived experience: the act of bringing women into a stadium where they are often culturally sidelined is itself symbolic.

The move also subtly repositions football fandom as a shared family experience rather than male-coded territory. For Chelsea, this strengthens cultural relevance and loyalty beyond performance metrics on the pitch.

The risk is that such programmes remain small-scale and symbolic without systemic follow-through - but as part of H&F’s wider £250,000 commitment to ending violence against women and girls, it reads as embedded rather than tokenistic.

📌 Key Takeouts

What happened: Chelsea Women offered free tickets to survivors of domestic abuse, in partnership with Hammersmith & Fulham Council.

What worked: Created a safe, joyful community space while challenging gendered assumptions around football fandom.

Signals: Women’s football is increasingly used as a platform for social progress, widening its cultural role beyond sport.

For marketers: Aligning brand moments with meaningful, lived experiences creates cultural resonance without feeling performative.

🔮 What We Can Expect Next

Expect more women’s teams - and progressive men’s clubs - to lean into similar partnerships that intersect sport, wellbeing and social support. This reflects a wider trend of football clubs acting as community anchors rather than just entertainment brands.

The challenge will be maintaining authenticity: audiences will quickly spot if such gestures become box-ticking exercises. For Chelsea, scaling this programme and making survivors’ presence a normalised part of matchday culture could set a benchmark across the league.

🔥 Armani’s Exit Plan: Who Wins if the House Sells?

Giorgio Armani’s will has landed like a carefully tailored shockwave: heirs must sell a 15% stake in the brand within 18 months, followed by up to 54.9% more in the years that follow. If that doesn’t materialise, an IPO is on the table. And Armani didn’t leave it vague - he named names: LVMH, L’Oréal, and EssilorLuxottica are all in pole position.

This isn’t just succession planning. It’s a strategic map that could reshape the luxury landscape in fashion, beauty, and eyewear. Here’s what it means depending on who takes the prize.

👜 If It’s LVMH

Implication: The most natural fit. LVMH has the infrastructure to absorb Armani across fashion, leather goods, and fragrance, and would fold it into a mega-portfolio that already includes Dior, Fendi, Loewe, and Bulgari.

Upside for Armani: Scale and global retail reach; protection against the mid-tier erosion Armani has faced.

Risk: Armani could be swallowed creatively, losing the independence and restrained elegance that’s defined the house since the ’70s. For LVMH, the question is whether Armani would grow the pie - or simply shuffle share within its crowded stable.

💄 If It’s L’Oréal

Implication: L’Oréal already runs Armani Beauty under license, so this would be an expansion of a proven relationship. Armani’s strength in fragrance and cosmetics could become the central play, with fashion as halo.

Upside for Armani: Beauty is where the growth is - L’Oréal has scale, distribution, and unrivalled marketing in the sector. This could reposition Armani as a lifestyle and beauty-first brand, closer to YSL Beauté than Dior.

Risk: Fashion could slide into the background, reduced to a storytelling platform rather than a growth driver. The Armani suit may become a billboard for Armani Code.

👓 If It’s EssilorLuxottica

Implication: Eyewear is one of Armani’s strongest licensing businesses already, and Luxottica is a powerhouse. This would be a category-led acquisition, less about fashion, more about global dominance in frames.

Upside for Armani: Guarantees longevity in a profitable vertical, keeping Armani eyewear central in the luxury segment.

Risk: The fashion house could become secondary, more a label feeding the eyewear engine than a fashion innovator. Armani risks being pigeonholed as an accessories brand.

📈 If It’s an IPO

Implication: The most “Italian” option, keeping Armani independent but subject to public markets. A Milan listing would give local markets a global luxury anchor alongside Ferrari and Moncler.

Upside for Armani: Retains its independence, legacy, and Foundation-led voting rights while unlocking liquidity.

Risk: Public markets are ruthless - margin pressure, fast-fashion competition, and the demands of quarterly earnings could put Armani in an uncomfortable position, especially given its relatively modest growth profile compared to Gucci or Dior.

🔮 What We Can Expect

Strategic Courtship: Expect LVMH and L’Oréal to quietly lobby behind the scenes; both bring synergies Armani specifically name-checked.

Category Rebalance: Whoever wins shapes Armani’s future focus: fashion (LVMH), beauty (L’Oréal), or eyewear (Luxottica). Each path redefines what “Armani” stands for in the next decade.

Cultural Signal: Armani was one of the last great independent European houses. His will acknowledges that scale wins in modern luxury. The next chapter is about whether Armani becomes a crown jewel in a conglomerate - or a listed Italian heritage player trying to run with global giants.

⚽️ Adidas Backs Latinas in Sport With DRAFTED & Melissa Ortiz

Adidas’ Community Lab is extending its grassroots influence with DRAFTED - a new initiative designed to support Latinas in sports. This week, they announced Melissa Ortiz - pro soccer player turned broadcaster - as their first-ever athlete advisor. It’s a move that blends representation, mentorship, and long-term community building, signalling Adidas’ commitment to elevating underrepresented voices in the athletic space.

📊 Supporting Stats:

Latinas make up just 2% of NCAA athletes despite representing nearly 10% of the U.S. population【source: NCAA/US Census】.

Women’s sport viewership continues to rise: the 2023 FIFA Women’s World Cup reached 2 billion viewers globally (FIFA).

According to Nielsen, 72% of sports fans believe brands should actively invest in women’s sports (2024).

🧠 Decision: Does It Work?

Yes - strategically, this is a smart play. Adidas isn’t just attaching its name to an existing platform, it’s helping build one from the ground up with authentic community roots. Ortiz’s profile as both a former pro and broadcaster makes her the right cultural bridge - credible on the field, relatable off it. The risk? Scale. Grassroots initiatives often struggle to sustain momentum without sustained investment and visibility. But as a brand move, it’s tightly aligned with Adidas’ broader positioning around inclusivity and sport as a cultural connector.

📌 Key Takeouts:

Adidas Community Lab launches DRAFTED, a grassroots initiative supporting Latinas in sport.

Melissa Ortiz named as the first athlete advisor - a dual role that merges player experience with media perspective.

The initiative addresses a clear participation gap and cultural representation issue.

Success depends on how much Adidas amplifies the platform beyond the launch moment.

Signals a shift: grassroots + representation projects are becoming central to how big sportswear brands drive credibility.

🔮 What We Can Expect Next:

Expect Adidas to lean into DRAFTED as both a mentorship platform and a content play - spotlighting stories of young Latina athletes through Ortiz’s lens. If executed well, this could become a blueprint for how brands activate around underrepresented communities in sport without coming off transactional. The bigger picture: with Nike, Puma, and others also chasing cultural authenticity, DRAFTED may push the industry to invest deeper in grassroots representation rather than just headline sponsorships.

🏎️ Adidas x Audi: Formula 1’s New Power Play

Adidas has locked in a multiyear deal with the Audi Formula 1 team, set to launch in 2026 when Audi makes its long-awaited entry into the sport. More than a kit deal, this partnership positions the three stripes not only in the pit lane but also in streetwear wardrobes worldwide. With Audi transitioning from Stake F1 Kick Sauber to its own branded team, this is a defining moment to shape its identity - and Adidas is stepping in as both outfitter and co-architect of the brand.

📊 Supporting Stats

Formula 1 audience surge: F1 attracted a cumulative TV audience of 1.5 billion in 2023, with social followers growing 23% year-on-year, driven by younger fans (Formula 1, 2024).

Adidas’ global edge: Adidas generated €21.4 billion in revenue in 2023, with performance categories (including collaborations like Messi and Yeezy) driving cultural relevance (Adidas FY2023 Report).

Brand crossover potential: 63% of Gen Z say they want fashion brands to collaborate with sports or entertainment properties that “reflect their identity” (WGSN, 2024).

🧠 Decision: Does It Work?

Yes - strategically, this is a sharp move. Adidas isn’t just sponsoring Audi; it’s embedding itself in the DNA of a new F1 team from day one. That means cultural storytelling rights, not just logo placement. Audi gains instant lifestyle cachet from Adidas’ global fashion and streetwear credibility, while Adidas secures access to the fastest-growing sports entertainment property worldwide.

Where it works:

Cultural crossover: Adidas has proven it can translate performance into lifestyle, from football to basketball. F1 - with Netflix’s Drive to Survive and global streetwear appeal - is fertile ground.

Timing: Announcing now gives Adidas and Audi 18 months to build hype, launch apparel drops, and prime audiences before the first race.

German heritage: Shared national roots give the partnership an authentic edge, rather than a forced brand fit.

The risk? Oversaturation. Adidas is already in bed with Mercedes F1, plus its Originals collabs with Bad Bunny and beyond. Without sharp differentiation, the Audi link could blur into background noise.

📌 Key Takeouts

What happened: Adidas announced a multiyear partnership with the incoming Audi F1 team, starting in 2026.

What worked: Shared German heritage, Audi’s brand-building moment, and Adidas’ proven ability to straddle sport and culture.

What didn’t: Adidas risks spreading itself thin across too many F1 and performance partnerships.

Signals: F1 is no longer just motorsport - it’s a lifestyle arena where apparel deals double as cultural positioning.

Brand takeaway: Embedding early in a team’s story creates deeper narrative rights than late-stage sponsorships.

🔮 What We Can Expect Next

Expect Adidas to test this partnership with limited-run Audi x Adidas collections - think Sambas reworked with pit-lane cues, or performance apparel dropped in sync with the 2026 car launch. If successful, other brands will follow suit, eyeing F1 not just as a hospitality platform but as a cultural playground. The bigger question: can Audi and Adidas together carve out an identity that feels distinct from Mercedes’ fashion-leaning plays, or will the three stripes risk racing itself into brand fatigue?

🏀 Power, Pay & Pressure: WNBA’s CBA Fight Hits Washington

With the WNBA’s CBA deadline looming on 31 October, the battleground has shifted from the court to Capitol Hill. This week, 85 Democratic lawmakers signed an open letter to commissioner Cathy Engelbert, urging the league to “bargain in good faith” with the WNBPA. The move highlights how the fight over pay equity and shared revenue in women’s basketball has become a political flashpoint - and a cultural one.

📊 Supporting Stats

0% shared revenue: WNBA players receive no shared revenue under the current CBA.

NBA: 49–51% | NFL: 48.8% | NHL: 50% - players in other leagues take home close to half of league revenues (Democratic Caucus letter).

$1.1B: Global women’s sports revenues are projected to surpass this in 2025, up 300% since 2020 (Deloitte).

Overseas pull: 90+ WNBA players have played abroad in recent offseasons, with salaries in Turkey, Russia and China still dwarfing domestic pay (FIBA, CBS Sports).

🧠 Decision: Will It Work?

The letter works symbolically: it pushes the WNBA into the spotlight and positions players’ demands as part of a broader political and cultural movement around gender equity. For the WNBPA, this builds public pressure at a crucial negotiation moment.

But for the league, being called out by Congress risks reputational damage if it digs in. The optics of a sport that markets itself on empowerment but denies players shared revenue could prove increasingly untenable.

Commercially, the real question is whether the WNBA can accelerate revenue growth fast enough to sustain a more equitable model. Audience numbers and sponsorship investment are trending up - but not yet at NBA scale. The political intervention makes it harder for the league to argue that “growth first, pay later” is a viable strategy.

📌 Key Takeouts

What happened: 85 Democratic Caucus members sent a letter to the WNBA commissioner, urging fair CBA negotiations before the 31 October deadline.

What worked: The move amplifies players’ voices, reframing pay equity as both a cultural and political issue.

Signals: Fans, sponsors, and lawmakers expect women’s sports to align their business models with the empowerment narrative.

For brand strategists: The CBA fight isn’t just about salaries — it’s about whether the WNBA can authentically deliver on the brand promise of women’s sport as a growth market.

🔮 What We Can Expect Next

Expect the WNBPA to continue leveraging public sentiment - players’ stories, viral soundbites, and high-profile allies - to shape negotiations. If the league agrees to some form of revenue share, it could become a precedent for women’s leagues globally. If not, the risk is cultural backlash at a time when women’s sports have unprecedented momentum.

Brands aligning with the WNBA will be forced to pick a side: support players’ fight for equity, or risk being seen as complicit in holding the game back.

🎤 Leeds Levels Up: BST Team Launch New Roundhay Festival

EG Presents, the powerhouse behind BST Hyde Park, is expanding north with the launch of Roundhay Festival in Leeds. Set in the legendary Roundhay Park - a venue that’s hosted Michael Jackson, Madonna, The Rolling Stones and Ed Sheeran - the new event is pitched as a cultural flagship for the North. The first headliner hasn’t been revealed yet, but the move signals a clear attempt to rebalance the UK’s festival map and tap into Leeds’ music legacy.

📊 Supporting Stats

The UK live music sector was worth £5.9bn in 2023, with festivals contributing £1.76bn (UK Music, This Is Music report, 2024).

BST Hyde Park itself drew over 500,000 attendees in 2024, with headline sets from the likes of Shania Twain, Kings of Leon and SZA (AEG Presents).

Leeds’ visitor economy is valued at £2.2bn annually, with major events contributing significantly to regional hospitality and tourism (Leeds City Council).

🧠 Decision: Does It Work?

Strategically, this looks like a smart expansion play. AEG knows how to scale a premium festival brand, and Roundhay Park’s history gives instant credibility. Leeds already has a thriving festival scene (Leeds Festival, Live at Leeds), but Roundhay positions itself differently: polished, heritage-driven, and designed to rival Hyde Park’s global pull.

Culturally, it answers a long-standing critique: that London dominates marquee music events. For fans across the north, this creates a new gravitational centre. Commercially, it opens fresh inventory for sponsors, hospitality, and brand activations in a less saturated but highly engaged market.

The risk? Overlap and fatigue. Leeds Festival already commands loyalty with a younger, rock/indie demographic. Roundhay will need to carve out its own identity - premium bookings, multigenerational draw, and an emphasis on production quality.

📌 Key Takeouts

What happened: AEG Presents is launching Roundhay Festival in Leeds, modelled on BST Hyde Park.

What works: Strong venue legacy, city partnership, premium positioning, and potential to decentralise the UK festival circuit.

Signals: Growing demand for regional cultural flagships, and proof that brands see opportunity in taking a “BST formula” outside London.

🔮 What We Can Expect Next

Expect the first headliner reveal to set the tone - if it’s global and multi-generational (think Madonna, Beyoncé, or Springsteen), Roundhay could instantly lock in credibility. If AEG nails the balance between superstar bookings and local integration, Roundhay Festival could become a long-term fixture that shifts how brands and artists view the North.

If it underdelivers on talent or becomes too similar to Leeds Festival, it risks being seen as a cash-grab. But if it succeeds, this could mark the beginning of “premium city festivals” beyond the capital - Manchester, Birmingham or Glasgow could be next in line.

🔥 Netflix + Amazon: A Frenemy Alliance in Ads

Two of the biggest players in streaming - Netflix and Amazon - just shook hands on an ad tech deal that would’ve seemed impossible a few years ago. Starting Q4 2025, advertisers will be able to buy Netflix inventory directly through Amazon’s DSP, joining a line-up that already includes Disney, Paramount, NBCUniversal and Warner Bros. Discovery.

On paper, it’s simple: Netflix solves scale and measurement issues; Amazon strengthens its claim as the connective tissue of streaming ads. But strategically, this is one of those moments that shows how streaming’s new currency is less about exclusivity and more about interoperability.

📊 Supporting Stats

Netflix commands 8.8% of total U.S. TV viewing (Nielsen’s The Gauge, Aug 2025). Prime Video sits at 3.8%.

Global CTV ad spend is expected to hit $36B by 2026, up from $25B in 2023 (Statista).

Netflix’s ad tier, launched late 2022, now reaches 45M monthly active users globally (Insider Intelligence, 2025).

Amazon Ads already accounts for 13% of U.S. digital ad spend, behind only Google and Meta (eMarketer).

🧠 Decision: Does It Work?

Yes - strategically and commercially.

For Netflix, plugging into Amazon’s DSP is a shortcut to ad dollars at scale. Its ad tier has grown fast but still struggles with targeting sophistication and advertiser ease-of-buy. Amazon brings both, plus commerce data no one else can match.

For Amazon, this is about dominance. Owning the rails that everyone else has to ride on makes Amazon less of a media player and more of an infrastructure layer. With Netflix on board, its DSP becomes the one-stop shop for premium CTV inventory.

Culturally, this is less “Netflix being bold” and more Netflix recognising it can’t go it alone in advertising. The win is in pragmatism: showing that partnering with rivals doesn’t dilute brand equity if the value exchange is clear.

📌 Key Takeouts

What happened: Netflix partnered with Amazon Ads to sell its inventory programmatically via Amazon’s DSP across 12 major markets.

What works well: Netflix gains immediate scale, targeting sophistication and commerce data access. Amazon gains the final premium puzzle piece for its DSP dominance.

Risks/weaknesses: Netflix risks handing too much leverage to Amazon, creating dependence in a space it wants to own long-term.

Strategic signal: The streaming ad economy is shifting from walled gardens to shared marketplaces, where convenience for advertisers outweighs exclusivity.

For marketers: Expect easier, centralised CTV buys but also less price transparency and potential concentration of power in Amazon’s hands.

🔮 What We Can Expect Next

This deal sets up a race for streaming ad infrastructure dominance. If Amazon becomes the de facto exchange for premium video, others (Google, The Trade Desk) will be forced to differentiate on measurement or data transparency.

For Netflix, the next move is proving that ads don’t just add revenue but also improve discovery and engagement. For advertisers, 2026 upfronts will look very different - more like buying search and social, less like TV.

The bigger question: will the convenience of a single DSP outweigh the risk of Amazon controlling so much of the ad supply chain?

🏉 Apple Puts Women’s Rugby Front and Centre for iPhone 17 Launch

At Apple’s iPhone 17 launch, the cultural spotlight didn’t just fall on the new “Air” model’s record-thin design. A global live stream with over 26 million viewers featured an advert that surprised many: a cameo from former Red Roses legend Shaunagh Brown, anchoring the spot in the rising energy around women’s rugby.

The tagline - “Any more Pro and it would need an agent” - played Apple’s traditional wordplay against the grit and professionalism of elite women athletes. The choice to integrate Brown wasn’t incidental; it was a signal of Apple’s intent to align the iPhone brand with authenticity, inclusivity, and sporting excellence at a time when women’s sport is commanding new commercial and cultural ground.

📊 Supporting Stats

Women’s Rugby Growth: Global participation in women’s rugby has grown by 28% since 2017, with World Rugby reporting 2.7 million registered players worldwide (World Rugby, 2024).

Broadcast Reach: The Women’s Rugby World Cup 2022 final drew a record 42,000+ live attendees at Eden Park and over 30 million viewers worldwide (World Rugby).

Brand Attention: Nielsen reports 63% of sports fans are now interested in women’s sports, up from 49% in 2018 - with women’s rugby ranking among the fastest-growing (Nielsen, 2023).

Apple attaching its flagship product to this momentum isn’t just opportunistic - it positions the iPhone as both technologically elite and culturally progressive.

🧠 Decision: Did It Work?

Yes - strategically, this landed.

Culturally, Apple tapped into the surging visibility of women’s sport, leveraging Shaunagh Brown’s reputation as both a former international and a vocal advocate for equality.

Commercially, the juxtaposition of “Pro” with elite athletes cements Apple’s product narrative without needing gimmicks.

Creatively, the ad’s balance of humour and credibility made it more than just a stunt - it gave Apple a talking point beyond specs and silicon.

If there’s a risk, it’s that Apple has set a high bar for cultural alignment. A one-off cameo won’t be enough - audiences will expect sustained investment in women’s sport.

📌 Key Takeouts

What happened: Apple used its global iPhone 17 launch to showcase an ad featuring Shaunagh Brown, watched live by 26M+.

What worked: Clever tagline, credible ambassador, strong cultural timing with women’s rugby on the rise.

Signals: Women’s sports are now mainstream platforms for premium brand storytelling. Aligning with them no longer looks niche, but necessary.

For brand marketers: This is a case study in matching product positioning (“Pro”) with a cultural force (women’s rugby) to broaden appeal without diluting premium codes.

🔮 What We Can Expect Next

Expect more tech and luxury brands to integrate women’s sport into flagship moments. Apple’s play may push competitors to move beyond football and basketball into more diverse sporting arenas where cultural narratives are fresher and less saturated.

For women’s rugby, this kind of stage visibility signals a tipping point: once Apple calls, others will follow. The challenge will be authenticity - not just cameos, but deeper collaborations, storytelling, and sponsorship.

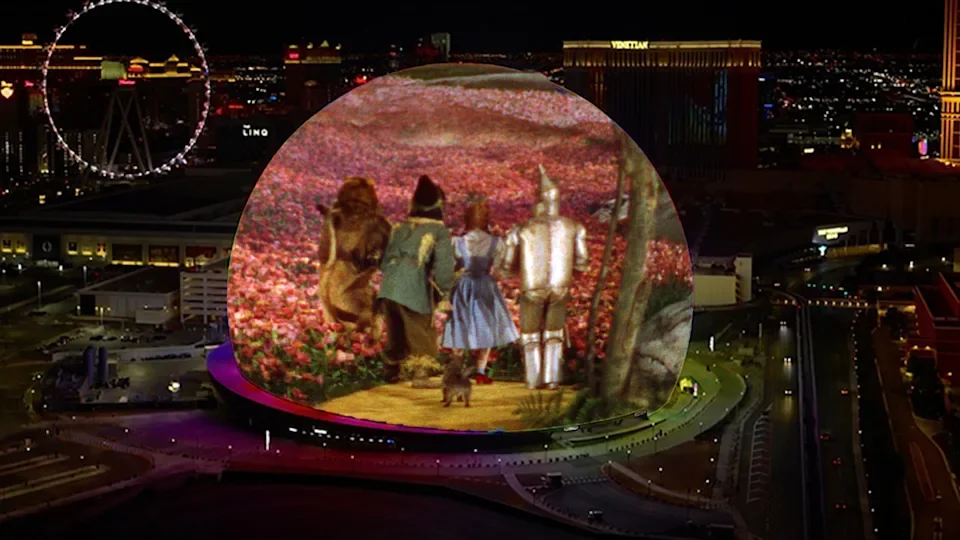

🌪️ There’s No Place Like Sphere: The Wizard of Oz’s Billion-Dollar Reboot

Eighty-six years after its 1939 debut, The Wizard of Oz is back on the big screen - only this time, the “big screen” is the 160,000-square-foot LED dome of Las Vegas’ Sphere. The venue’s digitally augmented re-release of the film, complete with AI-enhanced visuals, haptic seats, wind, scents, and drone-controlled flying monkeys, has turned a Hollywood relic into a billion-dollar box office force.

For Sphere, which has struggled to make concerts profitable, this marks a strategic turning point. For brands, it’s proof that heritage IP isn’t just for nostalgia - it can be re-engineered into blockbuster experiential content.

📊 Supporting Stats

The Wizard of Oz at Sphere is generating up to $2 million per day in ticket sales (Wolfe Research via SF Chronicle).

Analysts project the run could surpass $1 billion in revenue, outperforming Sphere’s 2025 concert business (Reuters).

By comparison, Sphere’s concert model delivered roughly $200 million in 2025 - half the forecast for film screenings (No Film School).

🧠 Decision: Does It Work?

Yes. Culturally and commercially, the move is a masterstroke. Sphere has shifted from high-overhead concerts to a model where it keeps full ticket revenue. Creatively, the AI-augmented Oz taps into intergenerational nostalgia while delivering a future-facing spectacle that feels less like a screening and more like a theme-park attraction.

The risk is purist backlash - some critics argue the classic is being “hacked” rather than honoured. But in a marketplace where audiences crave immersive, Instagrammable experiences, this approach gives Oz a new cultural lease of life.

📌 Key Takeouts

What happened: Sphere re-released The Wizard of Oz in a digitally augmented, immersive format.

What worked: The combination of heritage IP, AI visuals, and multi-sensory effects turned a 1939 film into a billion-dollar modern hit.

What didn’t: Some critics see the adaptation as a gimmick that compromises the original’s artistic integrity.

What it signals: Legacy content can be radically re-engineered into profitable new formats. Venues are shifting from concerts to immersive IP as revenue drivers.

For marketers: IP doesn’t age out if you find the right experiential frame - nostalgia plus novelty is a powerful formula.

🔮 What We Can Expect Next

Sphere’s success will set off a wave of immersive revivals. Expect studios and rights-holders to dust off cultural treasures (Star Wars, The Sound of Music, even Shrek) for re-engineering in immersive venues. But the risk of fatigue is real: if every classic gets “Sphere-ified,” audiences could tire quickly of the sensory overload.

For now, though, Dorothy, Toto, and that yellow brick road have proven there really is no place like Sphere.

🥤 Kith x Erewhon: $43K Membership for NYC’s Most Exclusive Grocery

The cult Los Angeles grocer Erewhon has finally crossed the Hudson, but in true Erewhon style, its debut in New York isn’t about accessibility - it’s about exclusivity. Tucked inside Ronnie Fieg’s new Kith Ivy/Padel 609 members-only complex in Greenwich Village, entry comes with a $36,000 initiation fee and $7,000 monthly dues. That’s $43,000 for the privilege of browsing Erewhon’s tonic bar in person.

This isn’t just a store opening - it’s a test case in whether New York’s elite will embrace Erewhon as more than a California curiosity and whether grocery shopping as performance still translates when behind velvet ropes.

📊 Supporting Stats

Erewhon reported selling up to 1,500 Hailey Bieber smoothies per day at the peak of its 2023 craze (Business of Fashion).

The US organic food market hit $67 billion in 2023 (Organic Trade Association), signalling appetite but also saturation in premium health categories.

Kith, Erewhon’s new partner, is valued at an estimated $1 billion after its stake sale in 2024 (Bloomberg), showing its power in bridging fashion, lifestyle, and community.

🧠 Decision: Did It Work?

From a brand-strategy lens, this move is more about symbolism than scale. Erewhon isn’t entering New York to sell groceries - it’s entering to maintain its mythos as the pinnacle of aspirational consumption. By situating itself inside Kith’s club, it fuses two forms of cultural capital: fashion credibility and wellness elitism.

Commercially, the footprint is tiny, with smoothies and juices as the only offerings. But culturally, it’s a flex. Erewhon is doubling down on exclusivity in a city where Whole Foods, Trader Joe’s and boutique markets already dominate daily shopping. For New Yorkers, Erewhon isn’t about filling your fridge - it’s about signalling that you can afford not to.

📌 Key Takeouts

What happened: Erewhon partnered with Kith to open a tonic bar inside a $43,000-membership club in NYC’s Greenwich Village.

What worked: Maintains Erewhon’s positioning as more status symbol than supermarket; aligns with Kith’s cultural cachet.

What didn’t: Limits scale and access; risks being seen as self-parody in a city already stretched by inequality and affordability debates.

Signals: The rise of membership-only wellness as the next layer of lifestyle luxury; groceries become performance and social currency, not utility.

Brand lesson: Scarcity and cultural theatre can fuel desirability - but if overplayed, exclusivity risks alienating more than it attracts.

🔮 What We Can Expect Next

If this tonic bar proves successful, a standalone Erewhon in New York is inevitable. But the bigger signal is what’s next for luxury food retail. We may see more “clubhouse groceries” emerge, where wellness consumption is folded into social spaces, fashion, and sport. The risk? Cultural fatigue. The same TikTokers who made Erewhon a meme could just as quickly turn against $23 smoothies that require a $36,000 gate fee.

Erewhon isn’t betting on volume; it’s betting on vibe. And New York, perhaps more than anywhere, will decide whether that gamble holds weight east of Los Angeles.

🎤 Live Nation’s Flywheel: When One Company Owns the Concert Experience

If you’ve been to a major concert in the U.S., Canada, or Europe in the last decade, chances are Live Nation was running the show. The company sits at the centre of the live music ecosystem, from ticketing (via Ticketmaster) to venue operations, artist touring, and promotion. Earlier this year, The Wall Street Journal’s docuseries peeled back the curtain on how Live Nation built this dominance, revealing a “flywheel” strategy designed to capture every layer of the pipeline.

📊 Supporting Stats

In 2023, Live Nation reported $22.7 billion in revenue, a 36% jump from the previous year (Live Nation Earnings Report).

Ticketmaster processed over 600 million tickets globally last year, cementing its role as the default gateway to live shows (Live Nation Annual Report).

A WSJ breakdown of ticket economics showed that for a $100 face-value ticket, $65 goes to the artist, while Live Nation often captures a significant portion of the remaining $35 through service fees, venue concessions, parking, and promotions.

According to Pollstar, Live Nation controlled 70% of the U.S. concert promotion market in 2024, fuelling antitrust scrutiny.

🧠 Decision: Does It Work?

Commercially, yes. Live Nation’s vertical integration has created a highly profitable, resilient business model. By controlling ticketing, venues, and promotion, it locks in both artists and fans. Creatively and culturally, however, the picture is mixed. Artists benefit from massive global reach but risk becoming dependent on Live Nation’s infrastructure. For fans, the experience increasingly feels less about music and more about navigating fees, restrictions, and limited alternatives. Strategically, the flywheel works - but culturally, it breeds distrust.

📌 Key Takeouts

What happened: WSJ’s docuseries spotlighted Live Nation’s near-monopoly on live music.

What worked well: A powerful “flywheel” model that maximises profit across every stage of a concert.

What didn’t land: Rising frustration over ticket fees, access, and the lack of competition.

The signal: Fans are more aware than ever of the economics behind live music - and that awareness is shaping cultural narratives around fairness, transparency, and access.

Brand takeaway: Dominance can be commercially brilliant but culturally brittle. Long-term trust is built not just on reach, but on perceived fairness and value.

🔮 What We Can Expect Next

Scrutiny of Live Nation isn’t going away. U.S. regulators have already probed its Ticketmaster dominance, and fan-led backlash peaks with every high-profile ticket fiasco (see Taylor Swift’s Eras Tour debacle). Expect pressure for decentralisation: from emerging ticketing tech (blockchain-based platforms, artist-owned systems) to indie promoters positioning themselves as “anti-Live Nation.” For brands, the lesson is clear: market control can buy short-term profit, but cultural credibility depends on creating value without eroding trust.

🎟️ TikTok Turns Movie Hype Into Ticket Sales

TikTok isn’t just where movie trailers go viral anymore — it’s now where you can buy your seat. In a new partnership with Fandango, TikTok will allow users to purchase tickets directly in-app, starting with Disney’s Tron: Ares. This integration runs through TikTok Spotlight, the platform’s vertical dedicated to film and TV, and introduces a frictionless “Get Tickets” button that bridges hype with action.

For Disney and Fandango, this isn’t just a distribution tweak. It’s a test of whether TikTok’s cultural influence can convert buzz into box office revenue.

📊 Supporting Stats

50% of U.S. TikTok users have discovered a new movie on the platform, according to Fandango.

36% say TikTok inspired them to take action — from looking up showtimes to buying tickets.

TikTok reported 150M+ U.S. active users in 2023, making it one of the most powerful awareness-to-action pipelines in entertainment.

For context, Gen Z now accounts for 27% of U.S. moviegoers (MPA, 2024), making their behaviour central to theatrical success.

🧠 Decision: Did It Work?

Strategically, yes. This move addresses a long-standing industry gap: converting social buzz into actual box office sales. TikTok already shapes audience sentiment; now it shapes sales. For Tron: Ares, a sequel with cult IP but a mixed mainstream record, being able to capture Gen Z and millennial attention in-platform could be decisive.

However, the risk is over-reliance on hype cycles. TikTok virality is unpredictable, and a ticket button doesn’t guarantee conversion if the content itself doesn’t sustain interest. Still, as a test case, this partnership is well-timed — Disney gets a controlled rollout on a fan-driven title, while TikTok positions itself as an entertainment commerce hub.

📌 Key Takeouts

What happened: TikTok and Fandango launch in-app movie ticketing, debuting with Disney’s Tron: Ares.

What worked: Direct path from discovery to purchase; aligns with Gen Z consumption habits; strengthens TikTok’s entertainment credibility.

What’s risky: Conversion depends heavily on movie hype; could be more effective for blockbusters than niche titles.

What it signals: Social platforms are moving deeper into commerce integration — not just influencing culture, but monetising it.

For marketers: The line between media, commerce and fandom is collapsing. Campaigns must design for conversion at the point of hype, not weeks later.

🔮 What We Can Expect Next

If successful, expect TikTok to roll out the feature across more tentpole releases, potentially bundling exclusive clips or influencer-led promo with ticketing. Other platforms (YouTube Shorts, Instagram Reels, even Twitch) will be forced to consider similar integrations to keep pace.

The bigger question: does this mark the start of social platforms becoming the new box office lobby? If audiences adapt, the era of “discovery somewhere, purchase elsewhere” could quickly fade — with TikTok owning the funnel from hype to seat.

🔥 Arsenal x adidas x NTS: When North London Football Meets Underground Sound

Arsenal and adidas have teamed up with Dalston-born radio station NTS for a capsule collection that pulls directly from the streets surrounding the Emirates. More than just merch, this is a cultural alignment - the Gunners tapping into London’s underground music DNA to extend their presence beyond the pitch. With Arsenal men set to wear the range ahead of Champions League nights, it’s a play that fuses sport, style and sound at a time when football fashion is shaping streetwear’s future.

📊 Supporting Stats

The global licensed sports merchandise market is projected to hit $38.7B by 2032 (Allied Market Research, 2024).

adidas’ focus on collaborations has paid off: in 2023, collab-driven lines (from Wales Bonner to Gucci) contributed to a 12% lift in brand heat among Gen Z shoppers (WARC, 2023).

NTS reaches over 2.5M monthly listeners across 70+ cities, giving the collab cultural weight well beyond North London.

🧠 Decision: Does It Work?

Yes - this works commercially and culturally. Arsenal are moving in step with a generation that sees football shirts less as sportswear and more as cultural artefacts. By connecting with NTS, a platform with underground credibility and international reach, the club sidesteps the trap of feeling like a heritage-only brand. adidas, meanwhile, reinforce their edge in football–fashion crossovers, keeping Nike’s more performance-focused positioning at bay.

📌 Key Takeouts

What happened: Arsenal, adidas and NTS launched a capsule celebrating North London’s music and football identity.

What worked: Authenticity. NTS isn’t just a logo licence - it’s a cultural institution with ties to Arsenal’s postcode. The styling (gold crests, striped detailing, music-inspired graphics) balances football heritage with subcultural cues.

What didn’t: The range risks being seen as another high-priced limited drop (£70–85 hoodies and pants). Accessibility remains a tension for football clubs wanting to connect with grassroots communities.

Signals: Football–music crossovers are no longer side projects - they’re front-of-kit storytelling. Expect more brands to lean into partnerships that blend local cultural hubs with global reach.

For marketers: Authentic community-led tie-ins (music collectives, grassroots culture hubs, local artists) can extend a brand’s footprint without diluting core identity.

🔮 What We Can Expect Next

This collab shows how clubs are thinking like cultural brands, not just sports teams. Expect rival Premier League clubs to follow suit, either with local labels, nightlife institutions or digital-first platforms. The risk is oversaturation - if every kit drops a “collab capsule,” audiences may start to tune out. The winners will be those who can prove real cultural exchange, not just co-branded logos.

On The Record Linkedin Newsletter: 8th September 2025

🔥 Front-of-Kit, Front of Culture: London City Lionesses x TOGETHXR

London City Lionesses just rewrote the sponsorship playbook. Their new partnership with TOGETHXR - the women-athlete-owned media and commerce company co-founded by Alex Morgan, Sue Bird, Simone Manuel and Chloe Kim - is the first time a women-athlete-led brand has front-of-kit placement on a professional women’s sports team.

The 2025/26 Nike kit launches with TOGETHXR’s “Everyone Watches Women’s Sports™” mark when the Lionesses face Arsenal in the Barclays WSL opener. Beyond the surface, this move fuses two disruptors: a club founded to challenge football’s status quo, and a media brand built to shift the narrative around women in sport.

📊 Supporting Stats

Sponsorship imbalance: In 2023, women’s sport attracted just 13% of total sports sponsorship spend globally (Nielsen).

Fan interest is booming: Attendance for the Barclays WSL hit a record 1.3 million in 2024/25, up 20% year-on-year (FA).

Media visibility gap: Women’s sports receive only 15% of sports media coverage worldwide (UNESCO, 2024).

This deal sits at the intersection of those numbers: a kit sponsorship that is both media brand and cultural signal.

🧠 Decision: Did It Work?

Yes. Strategically, this partnership is bigger than a sponsorship logo - it’s a platform play.

For TOGETHXR, it’s an earned media goldmine. Every broadcast, photo, and fan replica kit carries their mission statement into mainstream football culture.

For London City Lionesses, it signals independence and alignment with values-led storytelling, a differentiator in a crowded league.

For fans, it’s proof that women’s sport is now strong enough to sustain its own ecosystem of athlete-driven brands, without waiting for validation from legacy sponsors.

The risk? Commercial upside may take time. Unlike a bank or airline sponsor, TOGETHXR isn’t paying to sell products directly to Lionesses fans. But culturally, this partnership is far more valuable: it cements the team as part of a wider movement.

📌 Key Takeouts

What happened: London City Lionesses and TOGETHXR announced the first-ever women-athlete-owned brand front-of-kit sponsorship in professional women’s sport.

What worked: Shared disruptive DNA; visibility for TOGETHXR’s rallying cry; authentic alignment between brand and club.

Potential weakness: Revenue return may not match traditional sponsors in the short term.

Signals: Athlete-owned brands are stepping into roles once dominated by corporate giants; women’s football is becoming the stage for cultural-first partnerships.

For marketers: Front-of-kit isn’t just advertising space anymore - it’s identity, narrative, and a chance to stand for something.

🔮 What We Can Expect Next

This could open the door to a new model of sports sponsorship where values-driven, athlete-founded brands occupy premium spaces traditionally reserved for legacy corporations. Expect more women-led collectives, athlete-backed ventures, and culture-first businesses to step in where traditional brands hesitate.

For women’s sport, the message is clear: it’s no longer just about visibility - it’s about ownership, authorship, and rewriting who gets to sit at the front of the shirt.

🔥 U.S. Open Style Wars: Why Adidas and Y-3 Are Winning Where Nike Is Slipping

The 2025 U.S. Open has been as much about fashion as forehands. Once the undisputed king of tennis apparel, Nike is finding itself outnumbered and, in some ways, outmanoeuvred. Adidas has overtaken Nike in seeded player sponsorships, with its luxury Y-3 line drawing attention far beyond Centre Court. At the same time, emerging players are aligning with challenger brands like Vuori, Lululemon, and On, signalling a fragmentation of tennis fashion that mirrors wider shifts in sport and culture.

📊 Supporting Stats

In 2022, Nike sponsored 21 of 64 seeded players; in 2025, that dropped to just 11. Adidas now leads with 15. (Lev Akabas, WSJ)

Google searches for “Y-3” reached a 10-year high in the U.S. during the tournament. (Google Trends)

Younger athletes are defecting: in 2022, 16 of the top-50 under-25s wore Nike, compared to three for Adidas. In 2025, both brands are even at eight. (WSJ)

Lululemon’s Frances Tiafoe earned $11m off-court in 2024, showing that athlete-brand deals beyond Nike can be just as lucrative. (Forbes)

🧠 Decision: Did It Work?

For Adidas and Y-3, absolutely. Adidas seized the chance to balance performance credibility with a cultural play through Yohji Yamamoto’s minimalist Y-3 collection. It won visibility on court and in search behaviour, embedding itself in tennis conversations beyond sport. Nike, meanwhile, still owns the marquee names—Sinner, Alcaraz, Sabalenka—but its volume strategy is fading. The swoosh’s bet on quality over quantity may pay off in finals showdowns, but culturally it risks ceding relevance to brands driving experimentation and lifestyle crossover.

📌 Key Takeouts

What happened: Adidas surpassed Nike in seeded sponsorships; Y-3 became a breakout fashion story; players like Tiafoe and Draper left Nike for challenger brands.

What worked: Adidas’s mix of bold design (Y-3) and strong retention of talent; challenger brands positioning athletes as the “face” rather than one of many.

What didn’t: Nike’s reduced visibility; an over-concentration on a few stars risks cultural invisibility outside headline matches.

Signals: Tennis is becoming a hotbed for lifestyle brands; athletes want to be central to brand storytelling, not just another in the Nike machine.

For marketers: Authenticity and individuality are beating uniformity. Being “the one” for an athlete has more cultural equity than being “one of many” at Nike.

🔮 What We Can Expect Next

The tennis apparel market is opening up in ways reminiscent of basketball a decade ago. Expect more lifestyle and luxury crossovers (Hugo Boss, Lululemon, On, Vuori) seeking credibility through individual athletes. Adidas’s Y-3 moment will push rivals to experiment with high-fashion collaborations, while Nike may need to rethink its one-kit-fits-all approach to maintain cultural edge. For fans, the court is becoming a catwalk—expect apparel to be a bigger driver of engagement than ever.