Nike has teamed up with Spotify for Make Moves, a new global campaign designed to tackle one of the biggest challenges in youth sport: teenage girls dropping out. The campaign invites girls to move to one song a day - a low-barrier ritual backed by playlists co-curated across Seoul, London and Barcelona, alongside Nike athletes, artists and creators.

Why does it matter? Because 85% of teenage girls globally aren’t moving enough (Nike data), and dropout rates in sport peak at this age. The campaign reframes sport away from elite performance and towards joy, culture and accessibility.

📊 Supporting Stats

85% of teenage girls worldwide don’t get enough physical activity (Nike, 2025).

By age 14, girls drop out of sport at twice the rate of boys (Women’s Sports Foundation).

Globally, 1 in 3 teenage girls cites lack of confidence as a key barrier to physical activity (UNESCO).

These numbers underline the stakes: without intervention, entire generations risk disengaging from movement at the very point it should be empowering.

🧠 Decision: Did It Work?

From a brand perspective, this is a strong move. Nike has long led in women’s sport campaigns (from Dream Crazier to Play New), but this time the strategy isn’t about elite inspiration - it’s about everyday entry points.

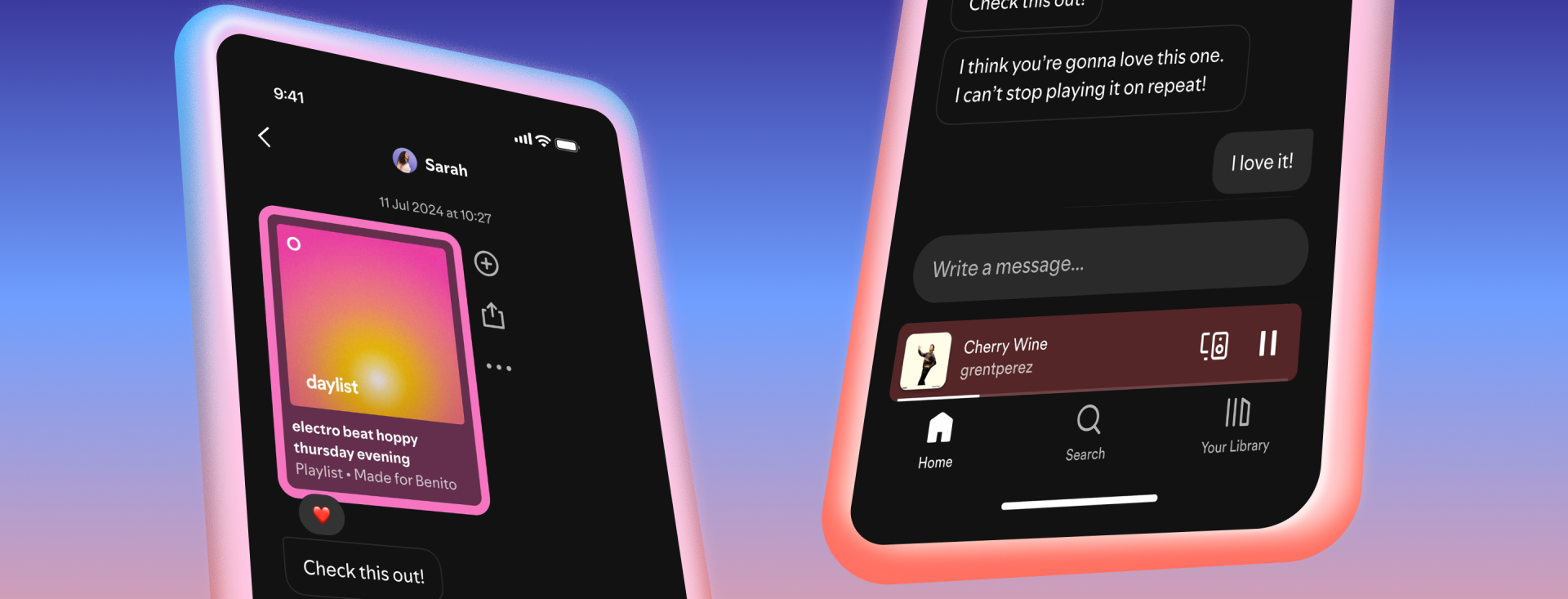

By leveraging Spotify, Nike meets girls on cultural turf they already inhabit. Music is universal, personal, and emotional - it removes the intimidation of “sport” and reframes it as “movement”. The playlist mechanic is clever: low pressure, repeatable, and fun.

Creatively, it positions Nike as not just a sportswear brand, but a facilitator of confidence, play and community. Commercially, it keeps Nike in the daily lives of Gen Z and Gen Alpha in a way that feels authentic rather than forced.

📌 Key Takeouts

What happened: Nike and Spotify launched Make Moves to tackle the teenage girl dropout crisis in sport.

What worked: A culturally fluent entry point (music + playlists), global co-creation with girls, and a focus on micro-rituals rather than elite performance.

What it signals: Sport brands are moving towards lowering barriers to entry, using culture (music, digital, creators) as the hook rather than competition.

For marketers: Rituals matter. Small, daily cultural behaviours can shift perception more effectively than lofty “just do it” slogans.

🔮 What We Can Expect Next

This feels like the start of a bigger pivot in youth sport marketing. Expect to see more brands use micro-moments and rituals as vehicles for participation. The question will be whether campaigns like Make Moves remain surface-level playlist drops or evolve into deeper ecosystems of support for girls - from school programmes to digital communities.

For now, Nike has created a smart, culturally resonant way to remind teenage girls: movement doesn’t have to be perfect, it just has to start.