Why Apple’s move into live F1 coverage signals more than a media land grab

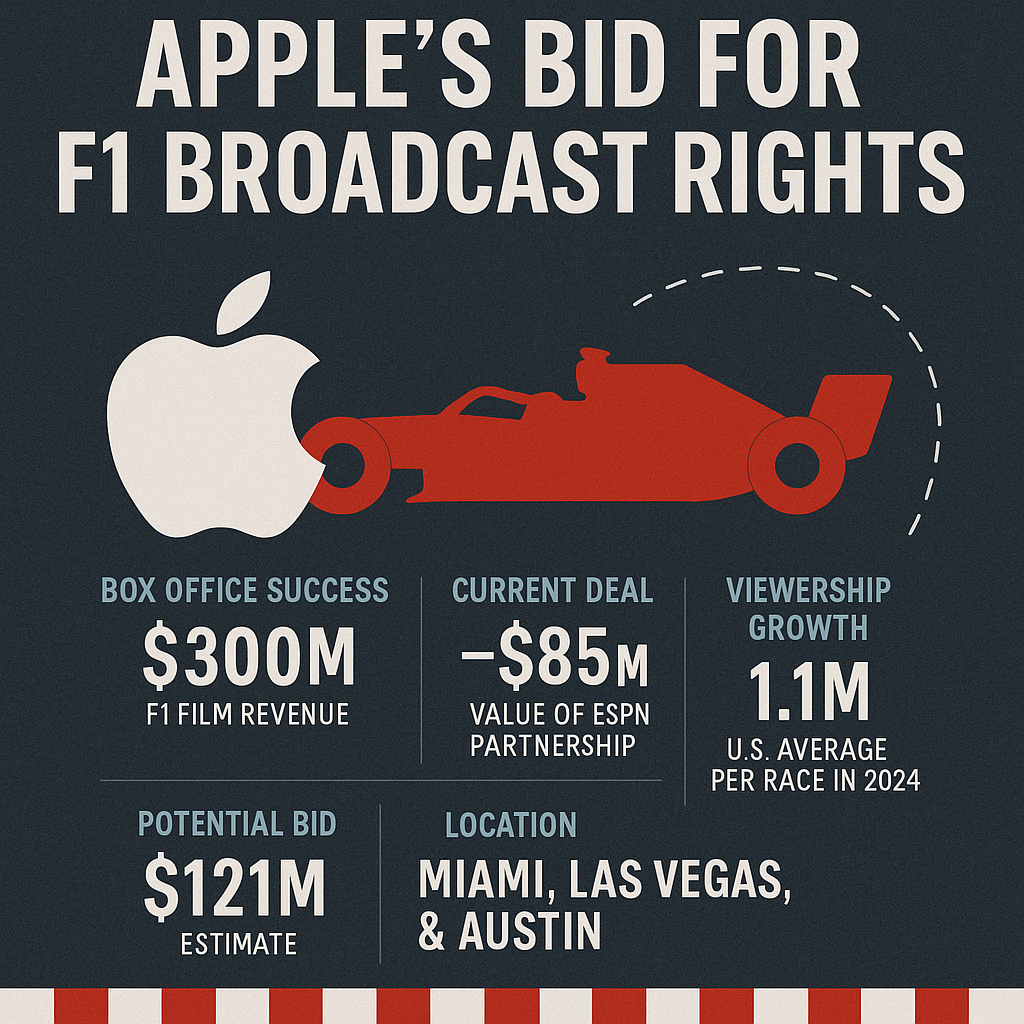

Apple is reportedly vying for the US broadcast rights to Formula 1, challenging Disney-owned ESPN as the sport’s current contract nears expiration. This move comes on the heels of Apple’s first box office hit, F1, starring Brad Pitt - a film that generated around $300 million globally and positioned the tech giant as a serious contender in mainstream entertainment.

Beyond broadcasting, Apple’s interest in Formula 1 is a signal to brand marketers, strategists, and rights holders: the convergence of content, sport, and culture is accelerating, and platforms are no longer just distributors - they’re experience makers.

📊 Supporting Stats

Apple’s F1 is now its highest-grossing original film, bringing in approx. $300 million (FT, July 2025).

Formula 1’s US broadcast deal with ESPN is currently worth ~$85 million annually. Citi analysts estimate the next deal could reach $121 million per year (pre-film release projection).

F1 viewership in the US has more than doubled under Liberty Media, from 554,000 in 2018 to 1.1 million in 2024.

Apple’s services revenue, which includes Apple TV+, reached $100 billion annually.

✅ Pros - Why Apple + F1 Makes Sense

Cultural Momentum

With the rise of Drive to Survive and celebrity-endorsed films like F1, the sport is reaching new demographics - notably younger and female audiences in the US.

Platform Synergy

Apple’s ecosystem allows seamless integration of content across devices, subscriptions, and services. F1 coverage could live alongside original films, fan engagement apps, AR experiences, and commerce touchpoints.

Advertising Value

F1 is premium inventory - global, high-income audience, live event-driven. Apple could elevate the commercial proposition with precision ad tech and first-party data.

⚠️ Cons - Strategic Risks and Uncertainties

Cost vs. Value

With expected rights costs rising, and the film’s momentum possibly hard to sustain, the ROI on a broadcast deal remains uncertain. Apple would be competing not just with ESPN, but potentially with other tech giants.

Streaming Saturation

Consumers are increasingly selective about subscriptions. Apple TV+ may struggle to convert sports viewers unless it bundles F1 meaningfully into broader offerings.

Control and Complexity

F1 already operates its own streaming service. Apple would need to navigate co-existence or negotiate exclusivity without undermining Liberty Media’s direct-to-consumer model.

🚀 Opportunities for Brands

Integrated Storytelling

F1’s fusion of technology, speed, drama and global locales is ideal for immersive, cross-platform brand narratives - especially in travel, luxury, automotive, and tech.

New Touchpoints

Apple’s data and device ecosystem (from iPhones to Vision Pro) could offer brands new tools for in-race experiences, AR overlays, and hyper-personalised campaigns.

Audience Growth

This shift could further energise the American market for F1, where interest is booming. For US-based or youth-targeting brands, it’s an opening to enter motorsport with cultural relevance.

🧱 Challenges Ahead

Rights Fragmentation

With multiple players eyeing F1, brands may face a splintered media landscape - requiring cross-channel coordination and careful ROI evaluation.

Creative Constraints

Apple’s tight control over brand integrations and user experience may limit sponsorship formats compared to traditional broadcasters.

Cultural Fit

F1’s identity is rooted in Europe and elite heritage. Maintaining authenticity while adapting to US and tech-driven formats will be a fine line to walk.

📝 Key Takeouts

Apple’s bid for F1 rights reflects a deeper integration of entertainment, sport, and platform power.

The success of F1 (film) may reshape how media companies value and approach sports IP.

Brands should view live sport not just as media inventory, but as a strategic cultural platform.

Apple’s ecosystem could redefine fan engagement, but risks remain around fragmentation and cost.

🔍 Next Steps for Brand Marketers

Audit your sports strategy: Is your brand showing up where culture is heading, not just where it’s been?

Explore integration models: Think beyond traditional sponsorship. What could your brand do with Apple’s tech if F1 goes live?

Track rights evolution: Whether Apple wins or not, F1 is becoming more premium and platform-led. Plan media budgets accordingly.

Experiment with immersive formats: Use this moment to pilot AR, audio, or in-race engagement ahead of mainstream adoption.